Understanding the Psychology of Pricing and Mastering Small Business Expense Tracking

While seemingly unrelated, the psychology of pricing and small business expense tracking are interconnected forces that can make or break a venture. Today, we delve into these vital subjects, unraveling the mysteries behind effective pricing and offering a comprehensive guide to tracking expenses for small businesses.

The Psychology of Pricing: Decoding Consumer Behavior

Pricing goes beyond numbers; it taps into the intricacies of human psychology. As a small business owner, understanding the underlying mechanisms that influence consumers’ perceptions and decisions can give a person a competitive edge. Here’s a glimpse into the psychology of pricing:

1. Anchoring: Consumers tend to rely heavily on the first piece of information they receive. By setting a high initial price and offering discounts, a business can create a perception of value and drive purchases.

2. The Power of “9”: Prices ending in “9” (e.g., $9.99) have proven to be more appealing to consumers. This strategy leverages the principle of left-digit bias, where individuals perceive a significant difference between $9.99 and $10, even though the actual difference is only one cent.

3. The Power of Comparison: Comparative pricing is a potent tool. By showcasing a higher-priced option alongside a slightly lower-priced one, a business can sway customers towards the latter, making it seem like a better deal.

Mastering Small Business Expense Tracking: A Comprehensive Guide

To achieve financial stability and optimize profitability, small businesses must meticulously track and manage expenses. Here’s a step-by-step guide to mastering small business expense tracking:

1. Categorize Expenses: Start by creating expense categories that align with the business operations, such as supplies, marketing, utilities, and payroll. This ensures a systematic approach to tracking expenses.

2. Capture Receipts: Develop a habit of collecting receipts for all business-related expenses. Digital solutions, like smartphone apps or cloud-based software, can streamline this process.

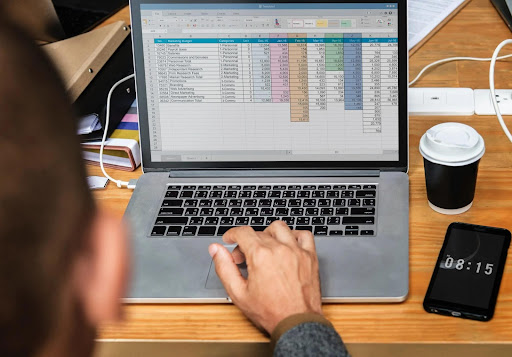

3. Establish a Tracking System: Implement a reliable tracking system that suits the business needs. This can range from simple spreadsheets to dedicated expense tracking software. Regularly update and reconcile the records.

4. Monitor Variable and Fixed Expenses: Distinguish between variable and fixed expenses. Variable expenses fluctuate with business activity, while fixed expenses remain constant. Analyzing both types helps identify cost-saving opportunities.

5. Set Budgets: Create budgets for different expense categories based on historical data and future projections. This enables better cost control and prevents overspending.

6. Review and Analyze: Periodically review the expense records to identify trends, pinpoint areas of overspending, and make informed decisions. Use this data to adjust pricing strategies and optimize profitability.

7. Seek Professional Assistance: Consider consulting with an accountant or financial advisor who specializes in small businesses. Their expertise can provide valuable insights and guidance to improve expense management.

By effectively tracking expenses and understanding the psychology of pricing, small businesses can streamline operations, boost profits, and enhance customer satisfaction. These two fundamental pillars serve as guiding lights in the pursuit of success.

As a small business owner, acknowledging the profound impact of the psychology of pricing and mastering expense tracking is key to achieving financial stability. By implementing the strategies outlined in this guide, a business owner can be well-equipped to navigate the intricate landscape of pricing and expenses, setting the business on a path to long-term success.

Media Contact

Company Name: HoneyBook – small business expense tracking software

Email: Send Email

Phone: 4155917768

Country: United States

Website: https://www.honeybook.com/